Download SECURIO

Malaysia’s safest browser & scam protection app. Block fake websites, phishing links, impersonators — and protect your parents & loved ones automatically.

- ✔ Blocks scam & fake websites in real-time

- ✔ Protects seniors & family members

- ✔ Uses Malaysia-focused scam database

- ✔ No technical setup required

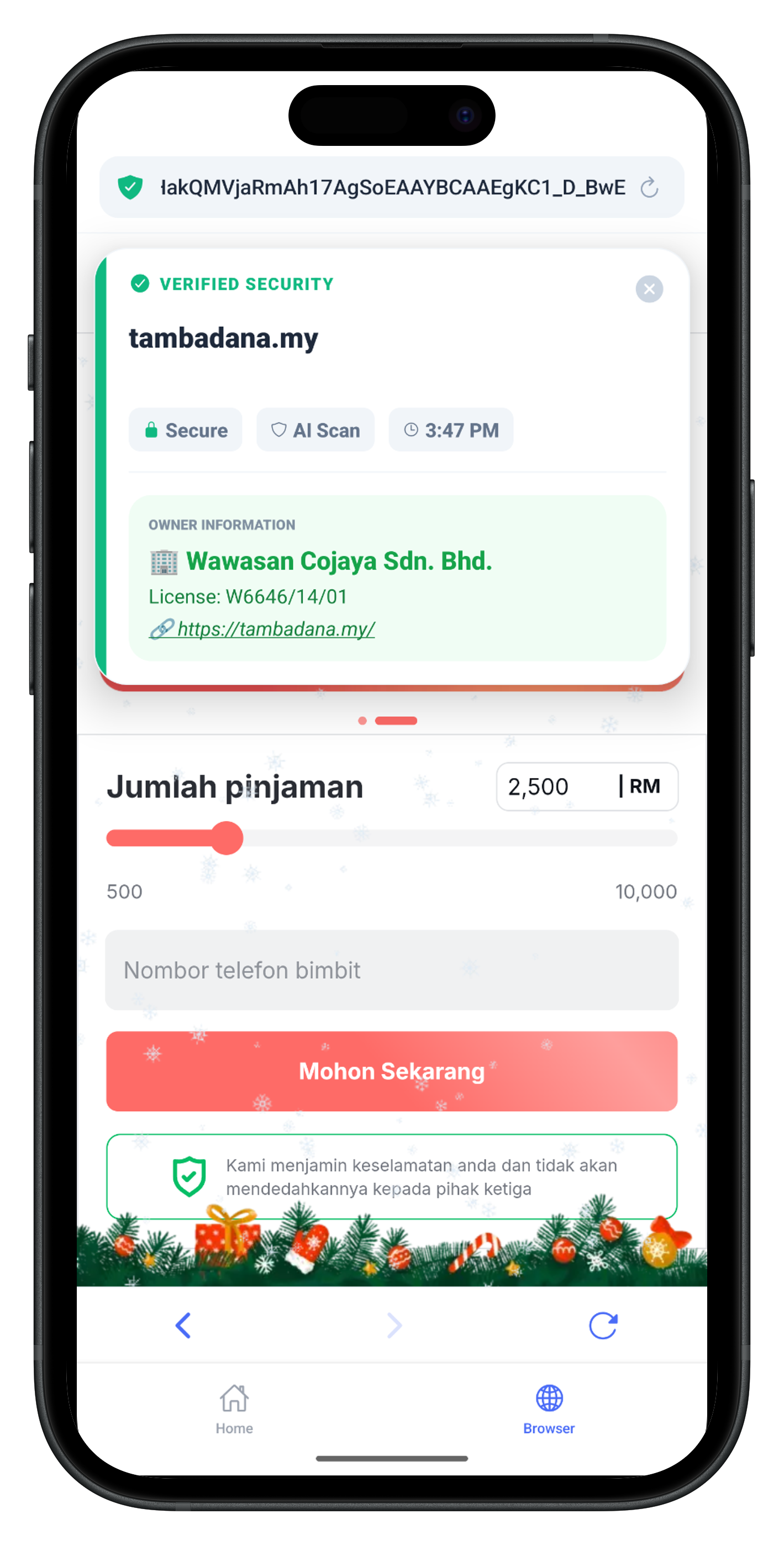

Check Before you Borrow

Verify lenders. Stop scams and stop losing money. Build trust with Securio.

Securio verifies lenders, websites, staff, and channels — bringing trust and compliance to every financial interaction

Connect securely across trusted platforms

X (Twitter)

WhatsApp

Telegram

Facebook

Built for the Regulated Lending Ecosystem

Verified Lender Identity

Securio confirms that every lender or agent on your platform is properly licensed and approved. We verify identities directly against official registries — so only genuine, authorized institutions can operate.

Borrower Protection & Fraud Prevention

Protect borrowers from impersonators, unlicensed lenders, and fake loan offers. Securio cross-checks all communication channels so customers only deal with verified representatives..

Compliance-Ready Verification Layer

Designed to meet AML, KYC, and consumer-protection standards, Securio creates clear audit trails that make regulatory reviews easy for both platforms and authorities.

Direct Registry Verification

We connect to government and regulatory databases to confirm license numbers, company directors, and authorized staff in real time.

Multi Channel Trust

From phone numbers and Telegram IDs to websites and emails, Securio verifies every contact point to block phishing and impersonation scams.

Enterprise-Grade Security

Data encrypted end-to-end, stored with regional compliance. Securio operates with zero customer data retention and full auditability for financial institutions.

Stop Lending Scammers. Protect Your Financial Identity.

Securio helps financial institutions, licensed lenders, and credit platforms prevent impersonation, fraudulent loan listings, and fake borrower activity. Verify parties securely while maintaining compliance and privacy — ensuring a trusted lending ecosystem.

Protect Your PlatformHow It Works

Securio provides a unified verification layer that brings transparency and accountability to the lending ecosystem — ensuring every interaction is trusted, verified, and compliant.

Connect Your Institution

Onboard your lending entity or financial platform with secure identity verification and registry validation.

Verify Identities Seamlessly

Securio confirms the authenticity of lenders, agents, and communication channels — ensuring every party is verified and compliant.

Enable Trusted Interactions

Share verified digital identities across your lending ecosystem, ensuring borrower trust and regulatory transparency.

Support & Help

Need help with the Securio app? Our team is here to assist you with account access, scam reports, false positives, and account deletion requests.

For account deletion, please use the in-app Delete Account feature or email support.

Ready to Strengthen Your Lending Integrity?

Join financial institutions and digital lenders using Securio to authenticate licensed operators, prevent fraud, and build borrower trust across all digital channels.

Launch with Securio